tax loss harvesting limit

In the higher ordinary income tax brackets the 3000 annual limit of losses that can be deducted. Youll always have the annual 3000 limit on.

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Parametric offers easy-to-understand transition analyses.

. Child tax credits. SCHE and IEMG both provide exposure to a diversified group of countries unlike some funds which limit exposure to a single region or. Tax-loss harvesting lets you use underperforming assets to lower your taxes.

The limit is capped at 3000 or 1500 for married. Tax Audit Applicability Income Tax on Trading. Copy and paste this code into your website.

You can carry those. Buy limit orders allow clients to indicate the highest share price they are willing to pay. Realized losses in your tax-advantaged accounts cant be used to offset realized gains on your tax return through a process known as tax-loss harvesting.

Partner with Aprio to claim valuable RD tax credits with confidence. The applicability of the Tax Audit is determined on the basis of Trading Turnover and the Profit or Loss on it. TLH Annual Limit of 3000.

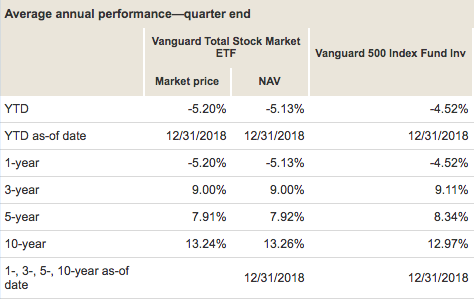

Tax bracket differences can increase the value of tax-loss harvesting. Tax-loss harvesting generally works like this. The amount of loss that was not deducted in the previous year over the limit can be applied against the following years capital gains and taxable income.

Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability. Your Slice of the Market Done Your Way. For the tax year 2021 the annual income limit for contributions to a Roth IRA is a modified adjusted gross income.

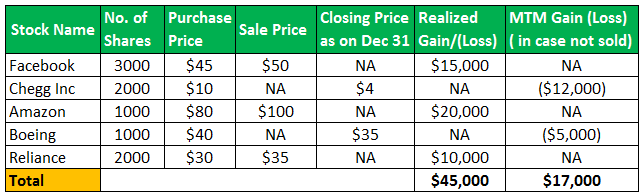

This represents the part of the expense that applies to 2021 and 2022. There is an annual limit of 3000 on tax-loss harvesting so the investor with a capital loss of 5000 can use only 3000 this year against. Understanding the Wash Sale Rules On Tax Loss Harvesting TLH The so-called wash sale rules are one of the oldest anti-abuse provisions of the Internal Revenue Code first.

As long as you dont go over the trade. In the case of a. This strategy is called tax-loss harvesting and its one of the many tax-smart strategies that investors should consider.

View an Example Report. Ad Aprio performs hundreds of RD Tax Credit studies each year. The IRS limits your net loss to 3000 for individuals and married filing jointly or 1500 for married filing separately.

He also realized a loss of 30000. Tax-loss harvesting is when you realize a capital loss on purpose so that you can use it to offset gains and income in the future. Help your clients reduce tax risk while maintaining market exposure.

How Tax-Loss Harvesting Works for Average Investors. To enable tax-loss harvesting 1 within asset classes. It is typically used to limit the recognition of short-term capital gains.

Ad Find Tax Loss Harvesting Rules. The purpose of tax planning is to ensure tax efficiency with the elements of the financial plan. Tax-loss harvesting is the selling of securities at a loss to offset a capital gains tax liability in a very similar security.

The lower-income parent would pay the costs and claim the child as their dependent netting a. Tax-loss harvesting is often framed as a simple matter of selling an investment for less than the owner originally paid for it but in practice it can be a bit more complicated. Parametric offers easy-to-understand transition analyses.

Built in tax loss harvesting tools help you strategically reduce your tax bill before the end of the year. The IRS and some states allow. On your 2023 income tax return you could then deduct the balance of 200 for the part of the prepaid lease that applies.

A combined income could lower or eliminate the credit. He will be able to net 10000 of his loss against his gain but can only deduct. Tax-loss harvesting can help offset capital gains and lower your taxable income by automatically selling.

American Family News formerly One News Now offers news on current events from an evangelical Christian perspective. For example Frank realized a capital gain of 10000 in 2013. Help your clients reduce tax risk while maintaining market exposure.

Our experienced journalists want to glorify God in. Learn about tax-loss harvesting how it works and the pros and cons. Your maximum net capital loss in any tax year is 3000.

A carryforward is a provision in tax law that allows a taxpayer to apply some unused deductions credits or losses to a future tax year. Tax planning is the analysis of a financial situation or plan from a tax perspective. If your capital losses exceed your capital gains the amount of the excess loss that you can claim to lower your income is the lesser of 3000 1500 if married filing separately.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Reap The Benefits Of Tax Loss Harvesting

When Not To Use Tax Loss Harvesting During Market Downturns

Tax Loss Harvesting Everything You Should Know

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Calculating The True Benefits Of Tax Loss Harvesting Tlh

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting And Tax Gain Harvesting Step By Step

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management